The dream of homeownership is often accompanied by the responsibility of managing a mortgage. As a homeowner, you may have heard about refinancing—a financial strategy that allows you to replace your existing mortgage with a new one, potentially at a lower interest rate. In a fortunate turn of events, if interest rates drop significantly, it could be the perfect opportunity to explore refinancing options for your home. In this blog post, we will delve into the benefits of refinancing when rates are lower, empowering you to make informed decisions about your financial future.

UNDERSTANDING REFINANCING

Before we discuss the advantages of refinancing when interest rates decrease, let’s briefly understand what refinancing entails. Refinancing a mortgage involves obtaining a new loan to pay off your existing mortgage. This new loan comes with revised terms, which may include a lower interest rate, a different repayment period, or even a switch from an adjustable-rate mortgage to a fixed-rate mortgage. \

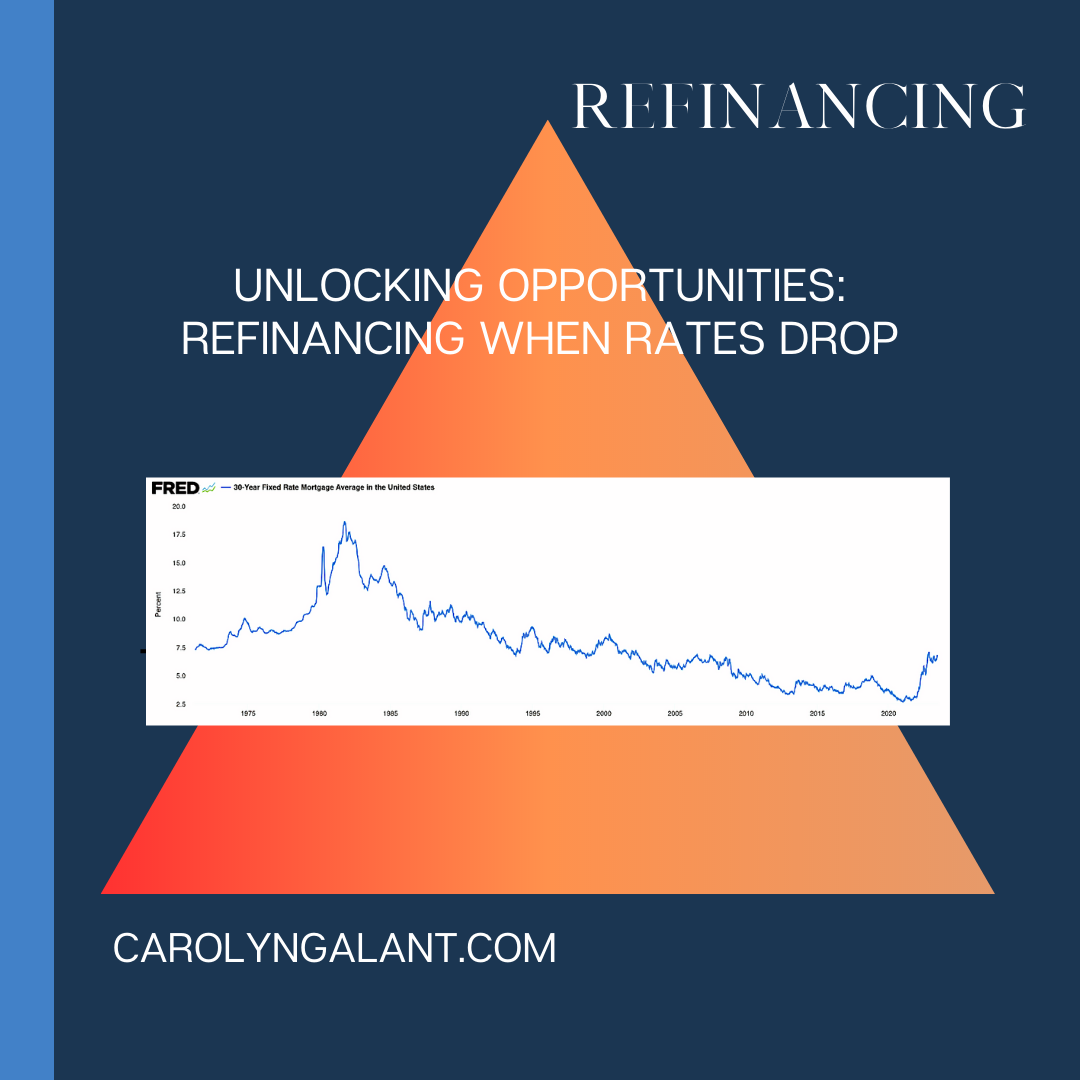

SEIZING THE LOWER INTEREST RATES

One of the most compelling reasons to consider refinancing is when interest rates drop. Interest rates play a significant role in determining the overall cost of your mortgage. If you have been diligently making mortgage payments and have built up equity in your home, taking advantage of lower interest rates can potentially save you thousands of dollars over the life of your loan.

REDUCING MONTHLY PAYMENTS

Lowering your interest rate through refinancing can result in substantial monthly savings. By securing a new mortgage with a lower interest rate, you may be able to reduce your monthly payments, freeing up valuable funds that can be redirected towards other financial goals or used for household expenses. This increased cash flow can provide greater financial flexibility and relieve some of the financial burdens associated with homeownership.

SHORTENING THE LOAN TERM

In addition to reducing your interest rate, refinancing when rates are lower can enable you to shorten the term of your loan. If you originally obtained a 30-year mortgage but now have the opportunity to refinance into a 15-year mortgage with a lower interest rate, you can potentially save thousands of dollars in interest payments over the life of the loan. Furthermore, paying off your mortgage sooner can bring you closer to achieving financial freedom and owning your home outright.

ACCESSING HOME EQUITY

If the value of your home has increased since you initially purchased it, refinancing can allow you to tap into your home equity. Through a cash-out refinance, you can borrow against the equity you’ve built and receive a lump sum payment, which can be used for various purposes, such as home renovations, debt consolidation, or funding education expenses. However, it’s important to carefully consider your financial situation and goals before leveraging your home equity.

Refinancing your home when interest rates drop can offer numerous advantages and unlock significant financial opportunities. By securing a lower interest rate, you can potentially save money on your monthly mortgage payments, reduce the overall cost of your loan, and even shorten the loan term. It’s essential to evaluate your current financial circumstances, compare different loan options, and consult with a mortgage professional to determine if refinancing is the right choice for you. Remember, refinancing is not a one-size-fits-all solution, and careful consideration is crucial to ensure it aligns with your long-term financial goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link